Like a friend, Insurance supports you and your family in challenging financial situations as it covers every type of financial risk. Even it will help your family after your death too! Neither can anything replace you, nor is anything will be equal to you. But the way you care for your family and provide the essentials to your family, i.e., Home, cloth, food, and education, Insurance will take care of all of that.

We wish you the best of health and long prosperous life, and with that, we are covering all of your financial risks in the worst times. So let us join hands so that we can take care of you and your family.

You constantly strive to provide comfort, happiness, and security to your family, and you would want your family’s future to be secure at all times.

ICICI Pru iProtect Smart gives you the flexibility to design your safety net so that you can protect your family’s future to ensure that they lead their lives comfortably without any financial worries, even in your absence.

This plan offers you cover against death, terminal illness, waiver of premium on permanent disability, and the option to enhance your coverage against Accidental Death and Accelerated Critical Illnesses a 360-degree cover on your life and is also available for sale through online mode.

You will also get tax benefits on premiums paid and the amount received, as per the prevailing tax laws.

Death Benefit Payout Options:

ICICI Pru iProtect Smart provides the flexibility to take the Death Benefit in a way that meets your financial requirement. The Death Benefit payout option has to be selected by you at Policy inception. The Death Benefit can be paid to your beneficiary as

- Lump-sum i.e., the entire benefit amount is payable as a lump sum.

Or

- Income i.e., 10% of the benefit amount, is payable every year for 10 years, this will be paid in equal monthly instalments

Or

- Lump-sum and Income i.e., the percentage of the Sum Assured to be paid out as lump sum is chosen at inception. The balance Sum Assured will be paid out in equal monthly instalments in advance at the rate of 0.83333% per month over 10 years.

Or

- Increasing Income, i.e., The benefit amount is payable in monthly instalments for 10 years, starting with 10% of the benefit amount per annum in the first year. The income amount will increase by 10% per annum simple interest every year after that.

Following Is The Example For Better Understanding:

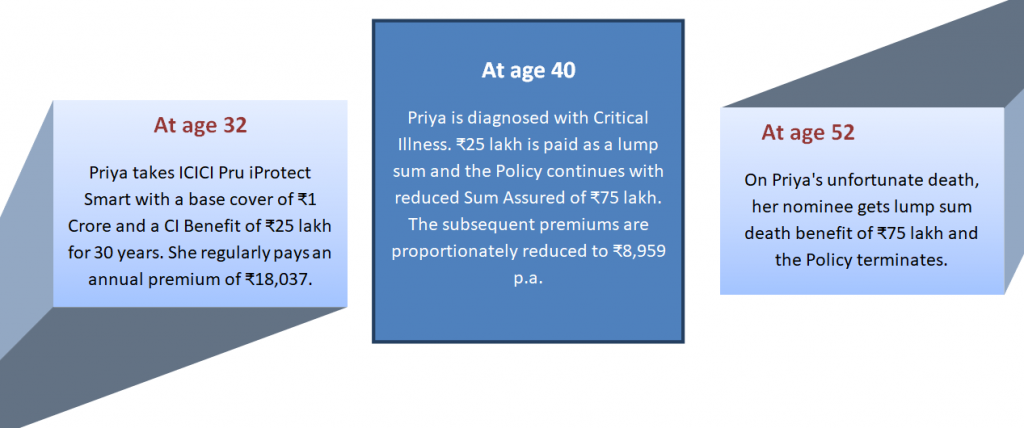

Priya is a 32 years old marketing consultant. She has availed of a loan for buying a house. Realizing the need for protection in her fast-paced life, Priya wants to be well prepared for unforeseen circumstances in life. ICICI Pru iProtect Smart provides the perfect solution for her needs.

To get more details drop an email at insurance@sh026.global.temp.domains or connect at 9141 888 444